It was a star-studded group that recently came together in Hollywood, but it was not for a self-adulating award show or a tribute to a Hollywood legend.

“Drag Isn’t Dangerous” was a four-hour telethon hosted by notable Hollywood stars and drag queens seeking support from the Left to combat the work of Family Policy Alliance.

The title of the telethon itself underscores the truth of what is at stake here. And without saying it in so many words, the dialogue among the promoters and hosts also seems to affirm what we already know.

Family Policy Alliance, the network of 40 state family policy councils we host in our alliance, the lawmakers we’ve trained through our Foundation’s Statesmen Academy, families like yours and supporters of our ministry are making a huge difference by enacting pro-family legislation again and again and again…

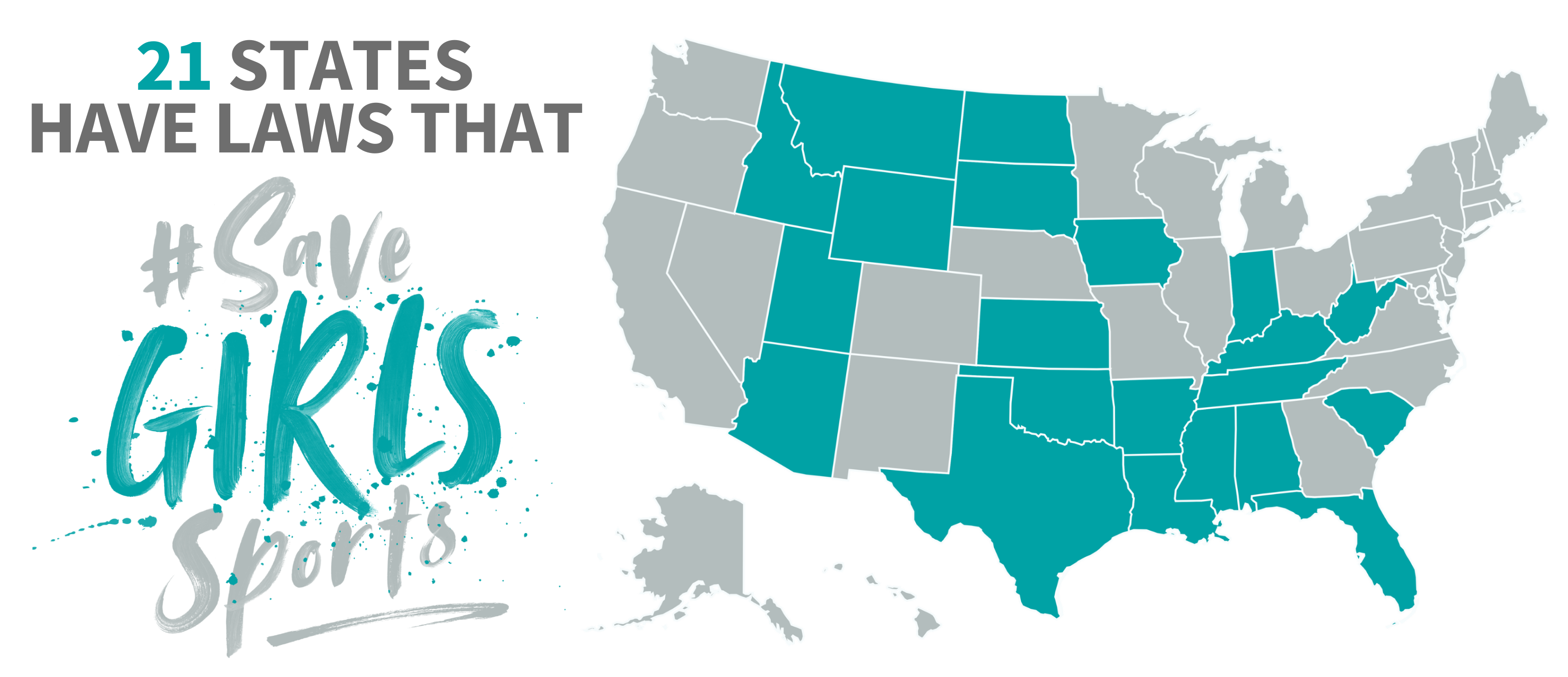

- Since 2020, 21 states have enacted a version of Save Girls Sports, legislation we pioneered with our allies in Idaho ensuring that girls’ sports are reserved only for girls.

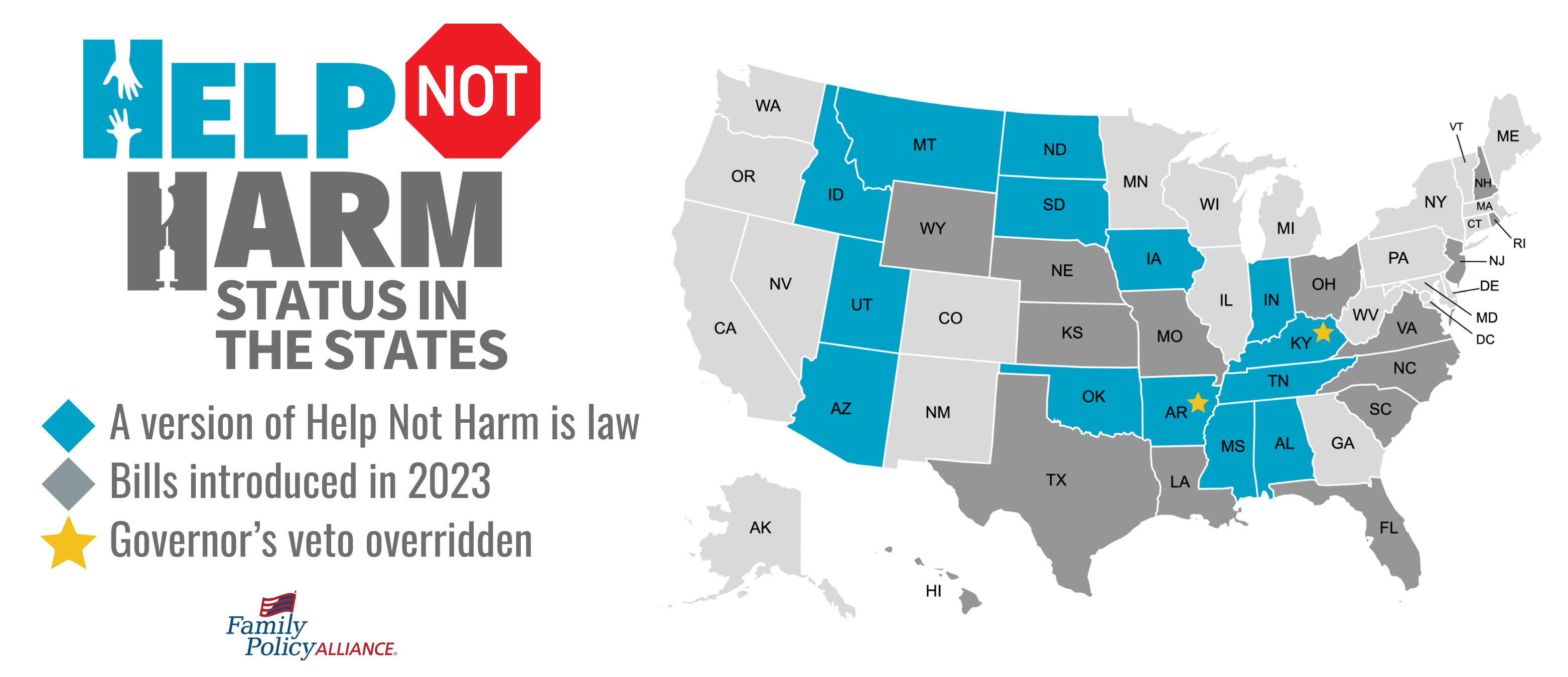

- Since 2021, 14 states (and counting!) have enacted a version of our Help Not Harm legislation protecting children from transgender procedures.

- That is 35 laws passed in over 20 different states – and it all started with Family Policy Alliance and the family policy council state allies representing your values.

Hollywood and the Left hate our work protecting families and this record of success – it is why they needed this telethon.

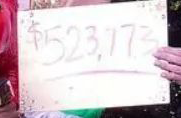

Unfortunately, “Drag Isn’t Dangerous” successfully raised over half a million dollars that will now flow directly to national groups who oppose our work every single day. This happened with help from the media, online promoters, producers and (in this case) the Hollywood bully pulpit – all things we do not have.

Unfortunately, “Drag Isn’t Dangerous” successfully raised over half a million dollars that will now flow directly to national groups who oppose our work every single day. This happened with help from the media, online promoters, producers and (in this case) the Hollywood bully pulpit – all things we do not have.

Let that sink in.

Hollywood just handed nearly $524,000 to multiple national groups whose daily missions are to stop our progress. They are all taking aim at the work of Family Policy Alliance and our record of success.

That is why we need your help.

Families like yours keep Family Policy Alliance going on our mission and we are asking that you stand with us by donating today.

Can you help us stand toe-to-toe with Hollywood and the leftists?

Just to keep up, we now need to raise $500,000 this month to counter this woke, Hollywood agenda…are you with us?

Blessings,

Craig DeRoche

President and CEO

PS: Did you know that we have some donors who have been giving a monthly gift to FPA for nearly 20 years? These faithful donors have seen the vision of FPA for decades and have chosen to partner with us for the long haul. Can you do the same? Click here to see how easy it is to set up a monthly donation. Any amount will help!